Part 1 – TECHNICAL ANALYSIS

Candlestick movements and formations are a crucial tool for traders looking to understand market trends and make informed decisions. Whether you’re a beginner or an experienced trader, mastering candle formations can significantly improve your ability to predict price movements. In this blog, we will explore the fundamentals of candlestick patterns, their types, and how you can use them effectively in your trading strategy.

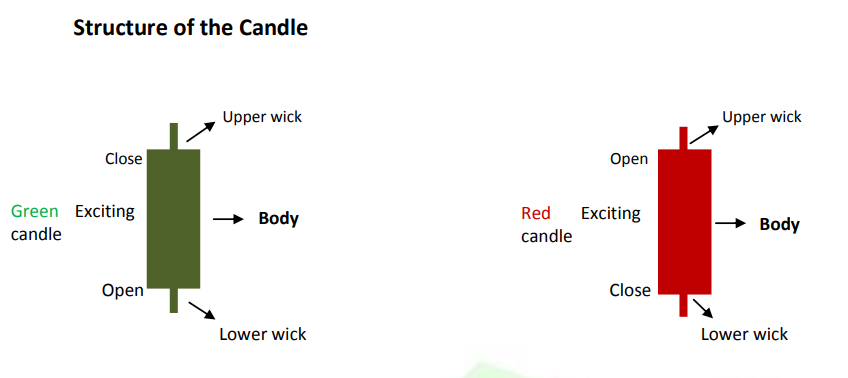

The Anatomy of a Candlestick

Each candlestick encapsulates a specific time frame and provides four essential data points:

1.Open Price: The initial price at which the asset trades at the start of the time frame.

2.Close Price: The final price at which the asset trades at the end of the time frame.

3.High Price: The maximum price reached during the time frame.

4.Low Price: The minimum price reached during the time frame.

The body of the candlestick represents the range between the open and close prices, while the wicks (also known as shadows) indicate the high and low prices within the period. A green (or white) body signifies a bullish candle, where the closing price is higher than the opening price, indicating buying pressure. Conversely, a red (or black) body denotes a bearish candle, where the closing price is lower than the opening price, indicating selling pressure.

Types of candles:

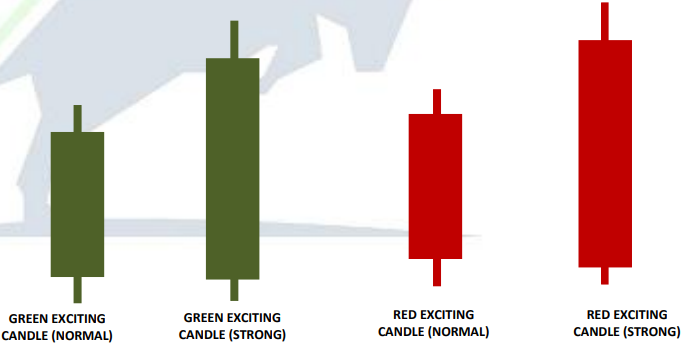

1.Excitig candles formation :

-> When the body part of overall candles is more than 50%, the candle is known as Exciting Candle. The body part of the

candle denotes the strength of the overall candle.

-> Candle Nos.1 & 3 in above mentioned diagram has more than 50% body of overall candle which makes it Green Exciting

Candle and Red Exciting Candle respectively.

-> Candle Nos.2 & 4 in above mentioned diagram has a same structure as candle nos.1 & 3, but has higher body part

(higher strength) hence, it is known as Green Exciting Strong Candle and Red Exciting Strong Candle respectively.

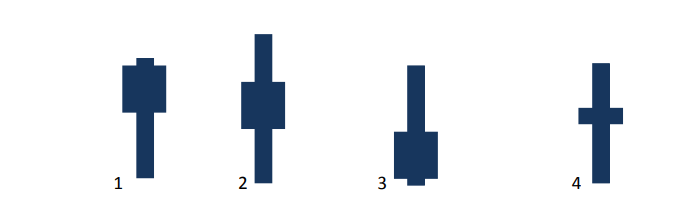

2.Base candles formation :

When the body of overall candle is less than 50%, the candle is known as base candle or we can say no of buyers

almost equal to no. of seller.

- This structure occurs when Buyers are marginally higher than Sellers i.e. 80,000 Buyers / 60,000 Sellers.

- This structure occurs when Buyers are marginally higher than Sellers i.e. 80,000 Buyers / 72,000 Sellers.

- This structure occurs when Buyers are marginally lower than Sellers i.e. 60,000 Buyers / 80,000 Sellers.

- Candle No. 4 reflects very small movement which denotes almost equal number of Buyers and Sellers.

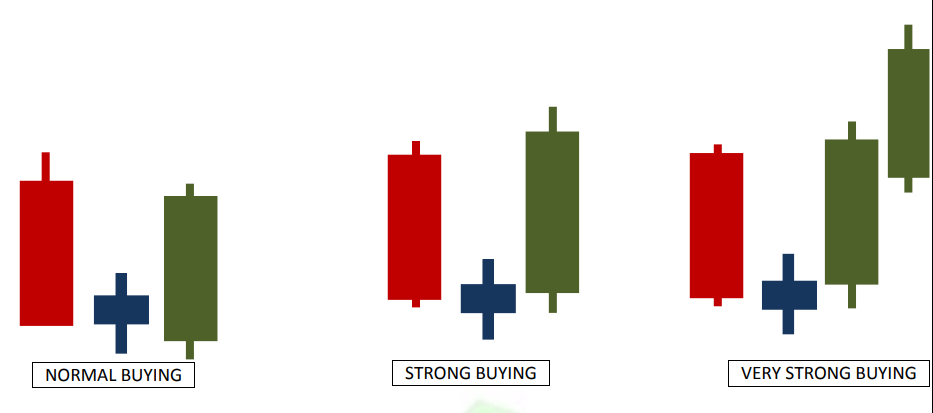

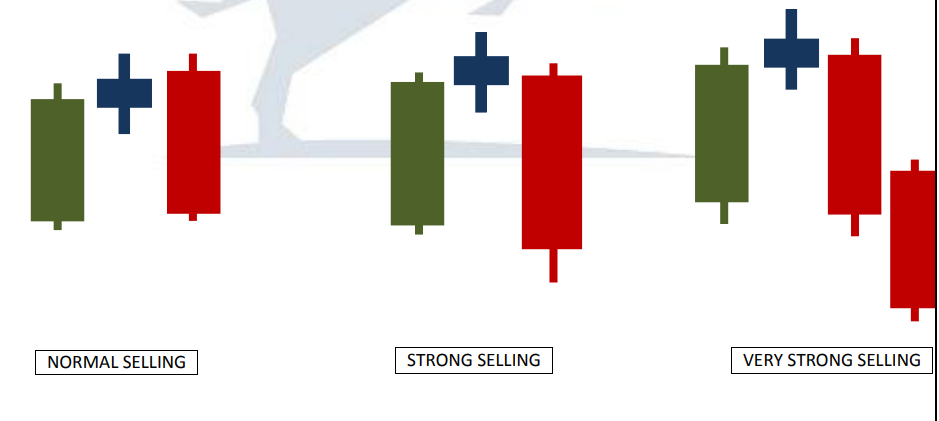

Strength of candles(Demand Zone):

Strength of candles(Supply Zone):

Key Candlestick Patterns

Understanding various candlestick patterns is crucial for anticipating market movements. Here are some fundamental patterns:

- Doji

A Doji occurs when the opening and closing prices are virtually equal, resulting in a very small body. This pattern indicates market indecision, as neither buyers nor sellers have gained control. The significance of a Doji is heightened when it appears after a strong bullish or bearish trend, suggesting a potential reversal. - Hammer and Hanging Man

Both patterns have a small body with a long lower wick and little to no upper wick.

Hammer: Appears in a downtrend and signals a potential bullish reversal. The long lower wick indicates that sellers drove prices down during the session, but strong buying pressure pushed prices back up, closing near the opening price.

Hanging Man: Occurs in an uptrend and suggests a potential bearish reversal. Despite opening higher, the asset experiences significant selling pressure, but buyers manage to push the price back near the opening level. However, the initial sell-off raises concerns about the strength of the uptrend.

- Engulfing Patterns

These are two-candle patterns indicating potential reversals:

Bullish Engulfing: A small bearish candle is followed by a larger bullish candle that completely engulfs the previous candle’s body. This pattern suggests a shift from selling to buying pressure.

Bearish Engulfing: A small bullish candle is followed by a larger bearish candle that engulfs the previous candle’s body, indicating a shift from buying to selling pressure.

- Morning Star and Evening Star

These are three-candle patterns signaling potential trend reversals:

Morning Star: Consists of a long bearish candle, followed by a short-bodied candle (which can be bullish or bearish) that gaps down, and then a long bullish candle that closes above the midpoint of the first candle. This pattern indicates a transition from a downtrend to an uptrend.

Evening Star: Comprises a long bullish candle, followed by a short-bodied candle that gaps up, and then a long bearish candle closing below the midpoint of the first candle. This pattern signals a potential reversal from an uptrend to a downtrend.

Implementing Candlestick Patterns in Trading

To effectively incorporate candlestick patterns into your trading strategy:

Combine with Other Technical Indicators: While candlestick patterns provide valuable insights, their reliability increases when used alongside indicators such as Moving Averages, Relative Strength Index (RSI), or the Moving Average Convergence Divergence (MACD). For instance, a bullish pattern confirmed by an RSI below 30 can strengthen the signal of an impending upward move.

Analyze Support and Resistance Levels: Identifying key support and resistance zones enhances the effectiveness of candlestick patterns. A bullish reversal pattern near a significant support level may indicate a strong buying opportunity.

Assess Trading Volume: Volume acts as a confirmation tool. A pattern accompanied by high trading volume is more likely to result in the anticipated price movement.

Consider Multiple Time Frames: Examining candlestick patterns across various time frames provides a comprehensive view of market dynamics. A pattern observed on a higher time frame may carry more weight than one on a lower time frame.

Common Pitfalls to Avoid :

Overlooking Market Context: Always consider the broader market environment. A pattern may have different implications depending on prevailing market conditions.

Relying Solely on Candlestick Patterns: Avoid making trading decisions based solely on candlestick patterns. Integrate other forms of analysis to confirm signals.

Neglecting Risk Management: Implementing proper risk management strategies, such as setting stop-loss orders, is crucial to protect against unexpected market movements.

Conclusion

Give more importance to the data in highlighted part, patterns that are mentioned in this article are not important at all , you can ignore them and just focus on the candlesticks study that is the most important part for learning. Continuous learning and practice are essential to effectively apply candlestick analysis in real-world trading scenarios.Stay tuned for more deep technical analysis of the candles and I can say that you will be profitable in the coming future if you follow these stratigies . Let us know in the comments if you have any doubts and querries!!

BUSINESS IDEAS & SIDE HUSTLES

Designed with WordPress