PART 4 – TECHNICAL ANALYSIS

Technical indicators play a crucial role in trading by providing insights into price trends, momentum, and potential reversal points. Moving Averages and oscillators like the Relative Strength Index (RSI) and Stochastic Indicator are some of the most widely used tools by traders. This blog will explore how to effectively use these indicators based on insights from professional trading methodologies.

Type of Movig Averages

- Simple Moving Average (SMA):

- Calculates the average price over a fixed amount of time.

- Reacts slower to price changes, making it useful for identifying long-term trends.

- Exponential Moving Average (EMA):

- Gives more importance to recent prices, making it more responsive to market fluctuations.

- Often used by short-term traders for faster trend identification.

Application of Exponential Moving Average

Golden Cross over : If lower moving average cuts higher moving average in upside

then it is called as a golden crosss over.

Death Cross over : If lower moving average cuts higher moving average in downside

then it is called as a death crosss over.

IMPORTANT POINTS

- MOVING AVERAGE WORKS PERFECTLY ONLY IN TRENDING MARKET .

- WE WILL LOOK FOR THE SETUP AS USUAL, WE ARE ONLY GOING TO USE (EMA) AS

AN ADDED TRADE SCORE . - IF MOVING AVERAGE TRADING THROUGH THE ZONE (20 EMA OR 50 EMA) THAN WE CAN

GIVE ADDITIONAL TRADE SCORE (1).

- MOVING AVERAGE SHOULD BE APPLY ON EXECUTION TIME FRAME ONLY.

- GOLDEN CROSS OVER IS FOR DEMAND ZONE (BULLISH).

- DEATH CROSS OVER IS FOR SUPPLY ZONE (BEARISH) .

Important Concepts in Moving Averages

- Golden Cross: Occurs when a lower moving average (e.g., 20 EMA) crosses above a higher moving average (e.g., 50 EMA), signaling a bullish trend.

- Death Cross: Occurs when a lower moving average crosses below a higher moving average, indicating a bearish trend.

- Moving Average in Trend Markets: Moving averages work best in trending markets, and they should not be solely relied upon in sideways markets.

- EMA as Trade Score Factor: If a moving average (20 EMA or 50 EMA) aligns with a demand or supply zone, it can add an additional trade score【85:5†source】.

RSI: Measuring Market Momentum

The Relative Strength Index (RSI) is a momentum checker that measures the speed and change of price movements.

RSI Levels:

- Above 70: Overbought conditions, potential for a price pullback.

- Below 30: Oversold situations, potential for a price reversal upward for buying.

- 50 Level: Acts as a neutral zone; a breakout above or below may indicate trend continuation.

How to Use RSI Effectively

- Positive Divergence: If price makes lower lows but RSI forms higher lows, it indicates a potential bullish reversal.

- Negative Divergence: If price makes higher highs but RSI forms lower highs, it suggests a bearish reversal.

- RSI with Demand & Supply Zones: If the price reaches a demand zone while RSI is in oversold territory, it strengthens the probability of a bullish move【85:1†source】.

Stochastic Indicator: Identifying Reversals

The Stochastic Oscillator measures the closing price relative to a price range over a given period.

Stochastic Levels:

- Above 80: Overbought zone, potential price drop.

- Below 20: Oversold zone, possible price increase.

Trading with Stochastic Indicator

- When the %K line crosses above the %D line in the oversold zone, it indicates a buy signal.

- When the %K line crosses below the %D line in the overbought zone, it signals a sell opportunity.

- Combining Stochastic with support/resistance zones can enhance trade accuracy【85:0†source】.

Combining Indicators for Stronger Signals

Using a single indicator is not always reliable. Combining multiple indicators can improve trade accuracy.

Example Trading Setup:

- Check the trend using moving averages (Golden Cross for uptrend when both the indicators crosses each other, Death Cross for downtrend).

- Use RSI to check whether the stock or the commodity is overbought or oversold.

- Confirm entry with Stochastic crossovers.

- Place stop-loss orders near recent support or resistance levels.

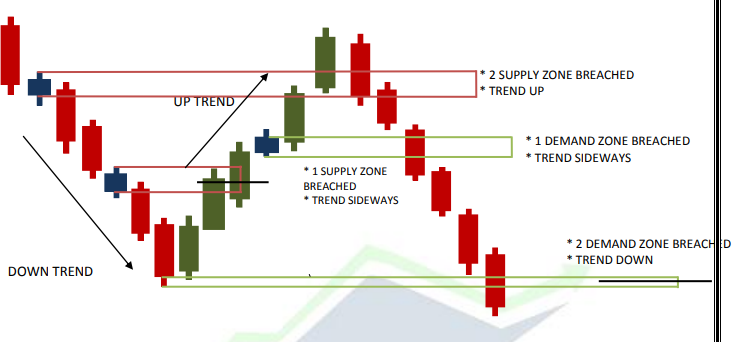

Advanced Trend Analysis

A. IF ONE DEMAND ZONE BREACHED THEN TREND WILL BE SIDEWAYS AND IF TWO DEMAND ZONE BREACHED TREND WILL BE

DOWN.

B. IF ONE SUPPLY ZONE BREACHED THEN TREND WILL BE SIDEWAYS AND IF TWO SUPPLY ZONE BREACHED TREND WILL BE UP.

Common Mistakes to Avoid

- Ignoring Trend Direction: Always trade with the trend to increase success probability.

- Using Indicators in Isolation: Combine multiple indicators to confirm signals.

- Overcomplicating Analysis: Too many indicators can create conflicting signals.

- Failing to Manage Risk: Always use stop-loss and proper risk-reward ratios.

Conclusion

Moving Averages, RSI, and Stochastic Indicator provide traders with valuable insights into market behavior. By combining these indicators and using them strategically, traders can increase their chances of making profitable decisions. Understanding how to interpret their signals and avoiding common mistakes will further enhance trading success.

Stay tuned for more trading strategies and market insights in upcoming blogs!

BUSINESS IDEAS & SIDE HUSTLES

Designed with WordPress

Leave a Reply