MACRO ECONOMIC DATA

Each day, the markets see the publication of important macroeconomic statistics. For example, it may be the BOE (Bank of England), which publishes the rate inflation, unemployment, etc … By other side it can be the Brexit news, the US announcing the number of jobs created per month (NFP), the index of consumer prices, manufacturing figures and interest rates etc … We will explain everything in detail below. We think is very important to talk about it.

Indeed these fundamental news can affect a currency in a positive way by increasing its value in the eyes of investors / traders or negatively making lose it’s value in the eyes of investors.

We want to point out that our system is based by 70% technicals and 30 % fundamentals;

THE IMPORTANCE OF FUNDAMENTALS IN FOREX

One thing that beginners in trading always do is often being unaware of the extent world of macroeconomic news that are published daily. This causes that financial markets breathe and constantly move which can be dangerous for those who do not know how to interpret them. The market sentiment changes.

The nature of technical analysis makes the price direction in the medium and long term almost predictable (with some exceptions), so no matter the number of news published.

However, the problem with the fundamental do not affect the price in the long term but in the short term, especially in Intraday charts: one hour, 30 minutes, 15 minutes, etc …

Fundamental news area an essential part of trading in forex. They help the markets move faster, creating huge liquidity in less time. They also create a lot of volatility, this can be combined with liquidity. The general consensus is and has

always been that “markets will follow the economic numbers.” That’s why it is necessary to learn to interpret these data.to improve our trading.

In Forex, fundamental in our charts illustrates the confrontation between an economy and another. For example, the charts will show us the EURUSD will show us EURO currency depending on the DOLLAR from the united states . It’s very important to know how to interpret the important data for the following countries:

Macroeconomic data from the US dollar affect the USD Those of Britain affects the GBP, those of Australia affects AUD, Japan (JPY), Swiss (CHF), New Zealand (NZD).

Let’s go to the heart of this chapter. From now on, we will analyze these macroeconomic data to understand the impact they will have on our pairs.

When a new economic news arrives, it is impossible to predict the reaction of prices in the short term. Usually, after a new fundamental published , volatility increase and make the market moves very aggressively. =MANIPULATION

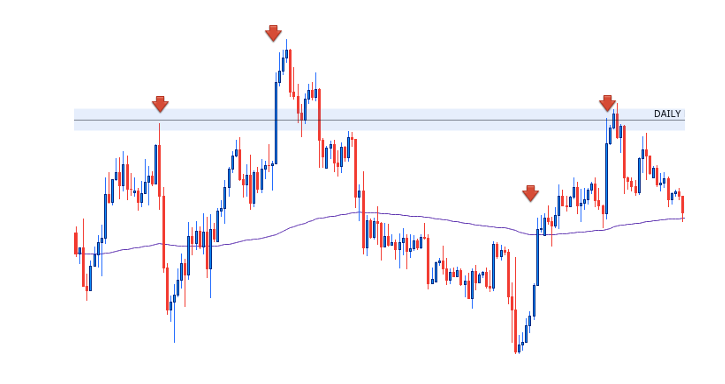

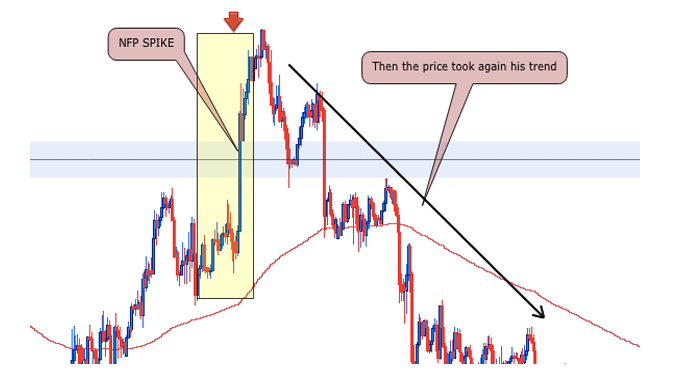

The image shows the volatility produced on each red arrow caused by a major economic announcement. In fact the news has brought a large volume, resulting from very large candles. Do not confuse this type of candles with candlestick patterns as engulfing or Marubozu. Indeed this kind of result is due to volatility in the short term market. News and candlesticks produced by news are not confirmations to take a trade.

Our mission is not to guess the direction of the price after the news was announced.

Indeed we can not control that. Nevertheless we will focus on what we can control, that means , the technical aspects of trading risk management and how to interpret the news.

Indeed we want to say that many people in this industry tend to pretend to be the new financial prognosticators, AIRFOREXONE don’t want to be that kind of mentors that teach you to expose your capital in high volatility moments. Instead, here we come to teach you how to protect your capital and trade smart.

HOW TO BE INFORMED OF THE ECONOMIC NEWS THAT WILL IMPACT THE FOREX?

ECONOMIC CALENDAR ON THE HUSTLE SPOT.

ECONOMIC CALENDAR ON INVESTING.COM

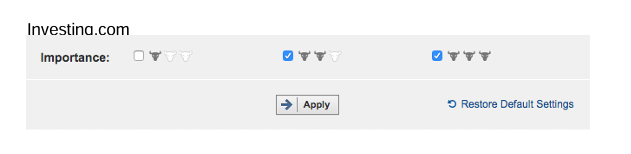

However, all the news does not have the same impact, so it is advisable to filter the most important news as the picture below shows.

With this configuration, only the news that will really have a big impact on forex will be visible.

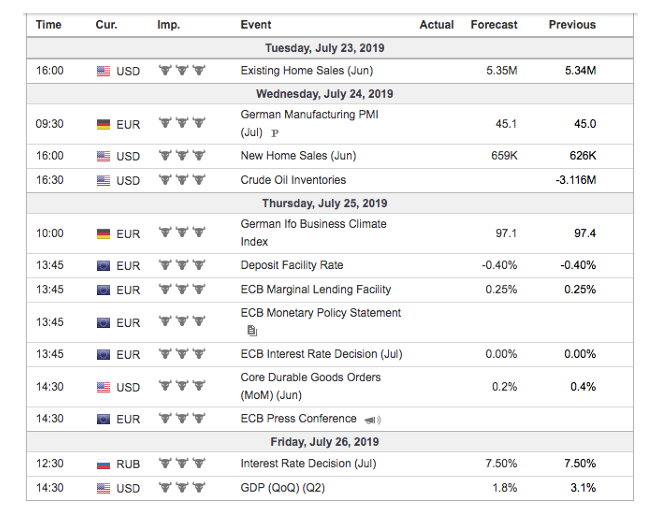

The image below is an economic calendar that we can find in investing.com that shows the most important news.

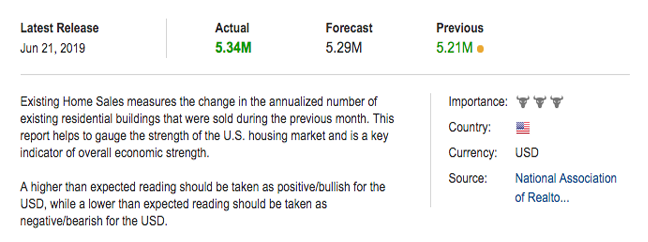

As we can see, on the right, we have a column “previous = last results” and in the center “forecast” and left “Actual, the expected result.”

How to interpret this?

When news happens, the current column is updated to a figure equal, lower or higher than the forecast column.

Simply if the result comes with the green color , it has a very positive impact on the currency in the game, while if the result are red color the impact is negative.

MACROECONOMIC APPROACH TO UNDERSTAND THE MARKET

INTEREST RATES:

Among the many existing news, there are some more important news that could increase volatility and strongly impact a currency.

A Government modify interest rates if he wants to increase or decrease the currency value.

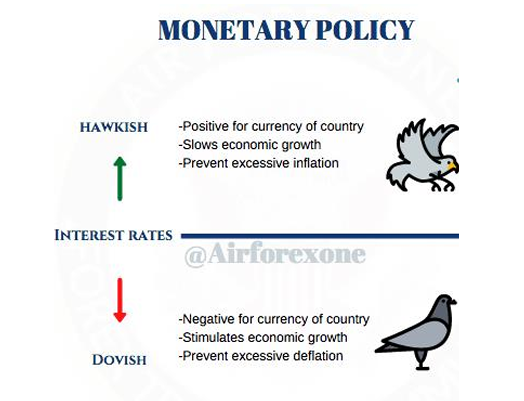

High interest rates: Higher interest rates mean that the currency appreciates in value due to increased investment in higher interest rate climate. However, a stronger currency has its own problems, it will make exports more expensive, and higher interest rates also make the cost more expensive loans. Furthermore if a country provides for an increase in interest rates that can greatly increase the value of the currency. In this case a country has an Hawkish monetary policy.

A country keep high interest rate in order to slow economic growth and prevent execessive inflation. So next time you see strong inflation don’t be surprised if they increase the next interest rates.

Low interest rates: When a currency cut its interest rates, the currency is devalued. In fact that happens because a country is having a bad moment.There is less investment, due to the lower rate of return. The low interest rates stimulate the flow of money, which is the backbone of forex. They adopt a “dovish “ monetary policy in order to stimulate the economic growth and fight against that “bad economics moment” .

A country keep low interest rates in order to stimulate economics growth and prevent excessive deflation. So next time you see low inflation or strong deflation.Don’t be surprised if they reduce interest rates to stimulate the economy.

Manufacturing data :

This is an indicator for industrialized countries. It can have a bullish reaction if the published results are higher than expected, and bearish if the published results are below expectations. USD and GBP pairs are very very sensitive to PMI manufacturing data.

Employment data:

The published results higher than expected will be considered bullish for this concerted currency. Since job creation is directly related to the economic growth of a country. Low unemployment data is good for the country .

The published results with lower expectations will be considered bearish for a currency, since job creation is low.= High unemployment data is very very bad for a country.

Inflation and consumer confidence: –

Higher inflation is a greater consumer confidence. This is a positive economic signal, so it brings a positive effect on a currency. Excessive inflation can lead to a Further hawkish monetary policy.

-A lower inflation and lower consumer confidence brings bearish momentum for the currency. In that case that can lead to a further dovish policy in order to stimulation inflation.

GDP (gross domestic product):

Considered a popular indicator: A higher GDP favors a bullish price for the currency. The higher the GDP, stronger will be the currency.

FOMC Meeting:

These are meetings where the Fed communicates if they plan to change interest rates. Then he published a statement explaining the decision. Meanwhile, during the meeting the volatility tends skyrocketing and it is better to wait for the announcement and interpret the results of the meeting as positive or negative.

Non Farm Payroll:

Non-agricultural jobs in the United States, announced on the first Friday of each month. This news is probably the one that has the most impact on financial markets and with which we will be more cautious.

What exactly is NFP?

It’s just a sign inform made by the statistical office of employment in the US.This statistics reproduce the total number of paid workers in the United States of

all businesses, excluding:

-Employees government.

-Domestic private -employees.

-Employees form non-profit organizations that provide assistance to individuals.

This monthly report also includes estimates of the average workweek and weekly incomes of all employees excluding agriculture sector. Indeed the total study sample represents about 80% of workers who contribute to US GDP! This statistic is published every first Friday of each month. The statistical assistance to government and policy makers to determine the economic health assessment and forecast future decisions.

NFP generates a lot of volatility in the market and sometimes become a market carnage immediately after the publication of the data, there will be a large price

movement on all USD pairs. It is recommended to not to trade the NFP day and wait until next week to see a less random movement in the market.

If the statistics show positive figures, the dollar appreciates in value. Normally this should raise all currencies starting with USD / XXX and bring down all the XXX /USD including gold (XAU / USD).

If the statistics show red numbers, they are seen as negative for the dollar.

Normally this should bring down all currency USD / … and raise all currencies … /USD including gold (XAU / USD).

Although it is sometimes said the price tends to ignore that. This is why it is often advised to avoid the first Friday of each month.

Now that we have seen the most relevant news, there are many minor news such as:

● Durable Goods Orders (Request for durable goods)

● Housing Starts Building Permits,(Authorizations of new housing and

permission to build)

● Industrial Production-Capacity Using (Industrial production and

industrial capacity in use.

● Initial Jobless Claims(Weekly News petitions unemployment insurance)

● ISM Non Manufacturing Index (Non-Manufacturing Index)

● New Home Sales (Sales of new homes.)

● Trump tweets

To find out what impact the news will have on the currency, what has to be done is to check the economic calendar and compare the projected values with the results out to an interpretation of how it could affect the result of the currency.

Here is the example of the interpretation of the new USD New home sales.

As a personal recommendation, every morning or before the beginning of the week, we recommend to open the economic calendar to see if the day you want to trade, there will be new high volatility. If you can not find 3 bulls, you are

looking to trade in a quiet day. If instead they are present, be careful because it is possible that the price makes a sudden movement in any direction.

In this way, before taking a position make sure there are no news related to this pair, so there will be no surprises for you. When you see news that arrive while you have an open trade, you can close or wait to see how the price act.

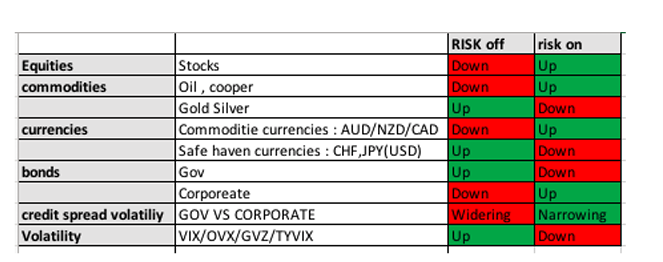

RISK OFF RISK ON SENTIMENT

When we trade forex we don’t only have to check the pairs we also need to see the other values.

When a market has a risk off sentiment : Stocks are to the downside , Oil and Cooper to the downside , Gold to the upside because is a safe haven value,Commodities currencies like aud nzd and cad are to the downside , Safe haven

currencies like CHF and JPY and even USD are to the upside… Volatility index to the upside.

Normally that happens when we have crisis for example with the coronavirus during the lockdown period market was with a risk of sentiment.

When a market has a risk On sentiment : Stocks are to the upside ( optimistic perspective) , Oil and Cooper to the upside , Gold to the downside because investor don’t need to protect themselves, Commodities currencies like aud nzd

and cad are to the upside , Safe haven currencies like CHF and JPY and even USD are to the downside… Volatility index to the downside.

Normally that happens when we have a optimistic perspective about the financial markets.

What we advise to you is to see the news and try to determine in what kind of sentiment do we are and in that way start finding opportunities to trade.

Conclusion:

The News is a key point in forex, it is very important to know that trading during the news market carries a higher risk, it will always be advisable to avoid days

charged of news because volatility tends to increase and you never know how the market will react. However, despite increased volatility, with good risk management, we can interpret the news and use them.

It is therefore essential that before opening an operation, you check if there is no news coming, otherwise you may see many surprises.

Leave a Reply