PART 6 – TECHNICAL ANALYSIS

Sectoral analysis is the process of studying a specific industry or sector to understand its performance, trends, risks, and opportunities. Investors, entrepreneurs, and policymakers use this analysis to make informed decisions about business strategies, investments, and economic policies. It provides insights into market demand, competition, regulatory changes, and technological advancements within a sector.

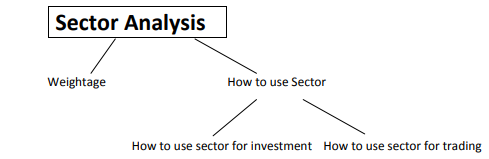

Sector Wise Analysis

Weightage – If highly weightage stocks of any particular sector are high then nifty of that particular sector may go up, whereas if

highly weightage stocks of any particular sector are down then nifty of that particular sector may also go down.

There is a direct relationship between highly weightage stocks and sector of that particular stocks.

For Example: it HINDCOPPER is going down than entire nifty metal may go down and vice – versa.

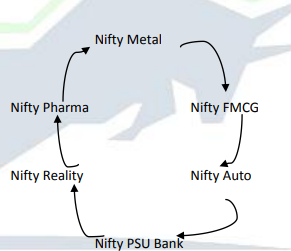

Sector rotation is very important to understand the concept of sector support.

All the sectors of nifty faces high and low They keep traveling, id one is high than other is low.

Different sectors rotate around each other. The cycle keeps on moving around, if Nifty Metal is high at

present then may be in future Nifty Metal may have a law. In the same way if Nifty Auto is low at present, then may be in near future Nifty Auto may have a high.

We will not go opposite/against the sector. rather we always need sector in our support/favor.

Hence, Sector support is one of the most important element while trading.

When Nifty on 29 Feb 2016 comes down in the demand zone, similarly SBIN also come down in the demand zone, which means

if NIFTY goes up, then SBIN also goes up as its already in the demand zone.

This is how Sector and Stock support each other.

HOW TO DO SECTOR ANALYSIS?

Firstly, prepare a separate market watch with all the sectors of Nifty.

Start from the Top-Down approach of the particular sector. From yearly to daily

After the selection of stock, if stock is in zone and sector of that particular zone is also

approaching towards its zone than the chances to react of that particular stock increases.

Sector and Stock support each other in the movement.

Booster Point :

If any single timeframe of sector coincide with stock we can give 2 No.

If get entry in both stock and its respective sector- we give 2 No.

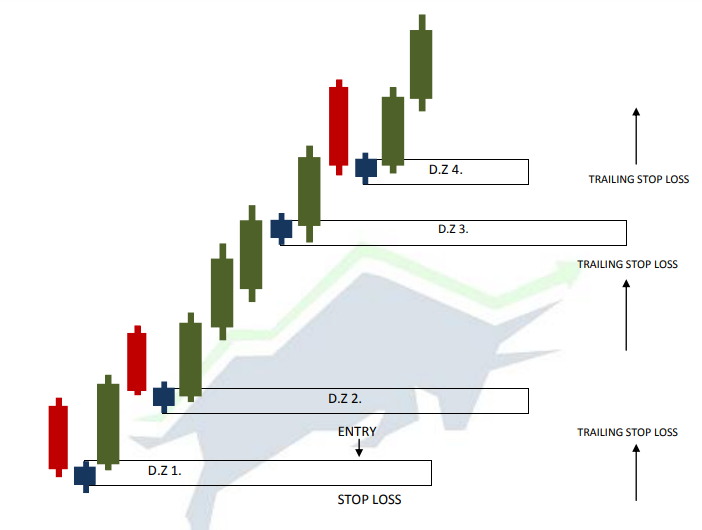

Stop Loss Trailing

We do stop loss trailing when the price is on all time high and forming new demand zones.

We shift our stop loss down to the distal line of newly formed demand zone and we will do this until it will get stop loss.

Conclusion:

Studying and understanding sectorial analysis is very important for executing best profitable trades , specially if you want to trade in indexes like Nifty50 & NiftyBank , and even Dow Jones. We have almost completed our study, if you want to master technical analysis keep trying , at least for two weeks try to mark the supply and demand zones and you can do paper trading.In future blogs I will also provide you some great demand & supply zones. These blogs are oly for educational purposes !!

Stay tuned for more insights and business ideas !!

BUSINESS IDEAS & SIDE HUSTLES

Designed with WordPress

Leave a Reply